| |

|

|

|

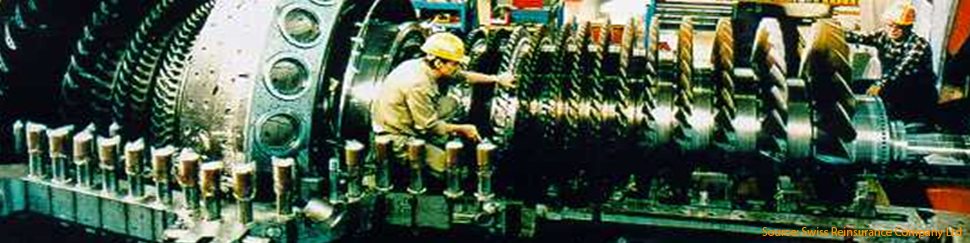

Machinery Breakdown Insurance (MBI)

The policy covers all losses or damages to the insured Machinery.

Scope of Cover

The policy cover losses or damages arising out of Machinery Breakdown due to any of the following causes:

- Internal: causes such as defective material, design, construction or erection

- External: causes such as falling, impact, collision or similar occurrences, obstruction or the entry of foreign bodies

Types of Property Insured

The policy covers all type machinery, plant, mechanical equipment and apparatus as under:

- Power generating units, e.g. boilers, turbines and generators

- Power distribution plants, e.g. transformers, high and low tension equipment

- Production machinery and auxiliary equipment

Insurance Period

The insurance period is specified in the policy schedule.

Insured Parties

The insured is specified in the policy schedule.

Underwriting Information

- The insured, the principal and other parties that have interests from the project.

- Plant layout

- Description of the machinery including size, capacity, etc.

- The repair facilities and the extent of maintenance or servicing

- The general housekeeping and working environment, including business efficiency

- The extent of obsolescence, if any

- The availability of replacement parts

- The territorial location

- The claims history in relation to the insured machinery

- The sums insured

Why you need Machinery Breakdown Insurance (MBI)

- Designed to cover expensive plant, machinery and mechanical equipment against unforeseen and sudden damage caused by breakdown.

- As machinery involves moving parts, their operation presents hazards to life and property-accident could occur

- Any industrial or manufacturing concern which operates machinery will need the protection of Machinery Breakdown Insurance

Claim Procedure

- In the event of any occurrence which might give rise to a claim under the Policy, the Insured shall:

- Notify CAMINCO directly or via agent/ broker immedately.

- Submit completed claim form or the loss adjuster's report providing most the information needed to ascertain whether or not the loss is covered.

- Immediately notify CAMINCO by telephone or telegram as well as in writing and supply all such particulars and proofs of a claim as may be required by the insurers

- Take all steps within his power to minimise the extent of the loss or damage

- Preserve the damaged property and make it available for inspection by a representative or surveyor of CAMINCO

- Inform the police authorities in case of loss or damage due to theft or burglary

- Advise CAMINCO of any other insurance covering all or part of the same risk.

- Where the loss is complicated, CAMINCO will appoint a loss adjuster to prepare a report, and the insured will provide the following information to the loss adjuster:

- The value of machinery, plant, mechanical equipment prior to or after loss

- The extent of loss or damage

- The cause of loss or damage

- The likely cost to repair

- Any uninsured element (apart from the deductible)

- The effect of extensive delays to the work

|

|

|